Transitioning from Traditional to Digital Loan Advisory

Read on if you are into Loan Advisory or Lending Business, uncover industry trends and competitors.

We are all witnesses of the big revolutionary wave brought by AI, but are you paying enough attention to what it brings for your business?

Being in the Loan Advisory or Consultancy Business makes you become altruist, prioritising your customer’s needs and requirements before everything else, since they come to seek clarity from you, for their wishes.

Loan Advisory Business is one of the domains where you have to make sure you are working on a fiduciary basis, comparing different loan options, multiple interest rates, hundreds of applications, bank profiles as well as client’s background, financials, debts, and goals.

Your hard work gets paid off when you deliver satisfaction to your customer, by helping them choose the best, from the sea of options.

But is this service good enough to keep filing your lead lists and returning customers?

If we consider the same question a decade ago, this might be sufficient. But with the enormous transformations since the last few years, the customer/ consumer behaviour has changed drastically, with new demands and needs, which you ought to satisfy, as the service provider.

Let’s consider some key market stats first.

The graph below shows the sanction growth, highlighting the increasing need of smaller loan size.

What does it take to be the Best Loan Consultant?

Well, for starters, be good enough at your consultancy service. You want to make sure you provide value, while staying upgraded with the right tech. Consider evaluating your ICP, drill down to the minute details of how they want to be catered, what frustrates them through the journey of opting for a loan, what are the major roadblocks they often face.

Make sure to know the industry trends. What’s making the market move?

If you are seeking funds, what are the investors seeking?

If you keep an eye on your market’s drivers, you would notice a pattern which leads them to success. It’s being digitally available to a vast target audience.

Up until now, having an office that runs on paper work and one on one meetings was enough to cater local leads, but with the change in service paths, this business model no longer serves your business goals. You need to market your services digitally.

Here's a list of your competitors, leading the Loan Advisory Industry.

Global Companies |

Indian Companies |

Check out what these companies are doing, to gain Funding and Growth.

You could be in any kind of domain under the loan consultancy industry, be it:

- Home Loan Consultancy

- Personal Loan Consultancy

- Auto Loan Consultancy

- Business Loan Consultancy

- Education Loan Consultancy

- Gold Loan Consultancy

- Debt Consolidation Loan Consultancy

- Loan Against Property Consultancy

- Mortgage Loan Consultancy

- Commercial Loan Consultancy

- Microfinance Loan Consultancy

- Government Loan Scheme Consultancy

- Corporate Loan Consultancy

- Car Loan Consultancy

- Refinancing Consultancy

Or, you could be providing a complete suite of Loan Advisory. Whatever it may be, the principle to get customers remains the same, i.e ‘give what they want, in the way they want it.’

Out of the total loans disbursed, digital lending has increased from 1.8 per cent in financial year 2022 (FY22) to 2.5 per cent in FY24. (Source)

Understand your customers. Everyone today wants to be tech savvy, have a quick disbursal, gain advice fast.

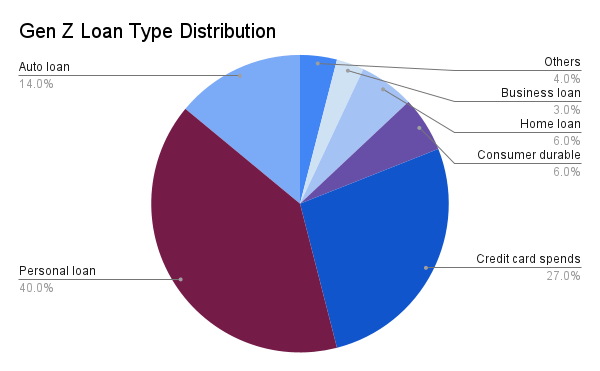

The infographic below makes a division in the borrowing patterns of GenZs and Millennials. (Source)

AI is no longer a futuristic fantasy; it’s rapidly transforming the loan advisory landscape. By leveraging the power of machine learning and data analytics, AI-powered tools are empowering both borrowers and lenders to make smarter choices and navigate the loan process with ease.

Here are some key trends in the usage of AI in Loan Consultancy to provide their customers premium experience.

Automated Loan Eligibility Checks:

Imagine a borrower uploading their financial documents to a platform. AI algorithms instantly analyze the data, cross-reference it with credit bureaus, and provide a preliminary eligibility assessment within seconds. This eliminates manual data entry and reduces wait times.

AI-Powered Risk Assessment:

AI analyzes vast datasets, including credit history, income patterns, and market trends, to predict loan default risks with greater accuracy. This helps lenders make informed decisions and offer competitive interest rates.

Chatbots for Customer Support:

AI-powered chatbots can handle common customer inquiries, such as loan status updates, repayment schedules, and document requirements. These chatbots operate 24/7, providing instant support and freeing up human advisors for complex issues.

Personalized Loan Comparison Tools:

AI algorithms analyze a borrower’s financial profile and goals to generate personalized loan recommendations. These tools compare various loan options, highlighting key features, interest rates, and repayment terms, empowering borrowers to make informed choices.

Connect with our experts to build your own AI Powered Loan Advisory Application.

Adoption Rate: A survey by Deloitte found that 70% of financial institutions are already using AI to improve customer experience, reduce costs, and manage risks.

Success Stories: Companies like Upstart, LendingClub, and Kabbage are leveraging AI to revolutionize the lending industry with faster approvals, lower interest rates, and personalized loan offers.

Included herein is a snippet for your research consideration.

The number of women borrowers with active loans grew 10.8 per cent to 8.3 crore as of December, which was higher than the 6.5 per cent growth for men. (Source).

Women continue to outperform men, demonstrating better borrowing behavior with lower PAR 91-180 DPD (days past due) across most products, except for Gold Loans, Two-Wheeler loans, (CRIF MARK). It was also found that “notable improvements” were observed in women’s behaviour in Home Loans, Business Loans, Agri & Tractor Loans, Property Loans, and Education Loans in the year to December 2024.

AI Agent in Loan Consultancy

With AI being utilised in all circles of business management, customer experience is not left far behind.

L&T Finance Launches AI-Powered Home Loan Advisor, KAI.

KAI offers real-time EMI calculations, personalised loan estimates, and intuitive support to simplify decision-making.

How do you achieve this status, gain market standing and scale your business efficiently?

By partnering with Loan software development Company. Custom Fintech Development Company can help you with understanding the current trends, acknowledge your vision and build it custom and tailor made for you.

A fintech development company would have the apt knowledge and expertise to guide you through the process of custom app development, and build it the way you want, for your customers.

Don’t worry if you don’t have the right words to explain your requirements. We will make sure we have a great brainstorming session to build something scalable, agile and secure.

Transform your vision with the right tech.