Fintech Essentials for Thriving in the Stock Market Business Landscape

Read if you are a Broker, Investment Advisor, Research Analyst or Trader with entrepreneur drive.

Considering your deep expertise in the stock market trading domain, with years of experience navigating the waves of profits and losses, market ups and crashes, you’ve certainly thought about building a business around it.

Maybe you already are a broker, investment advisor, research analyst, or a dedicated trader.

We bring you a concise industry trends report to help you understand the essentials for scaling your stock market trading business in 2025.

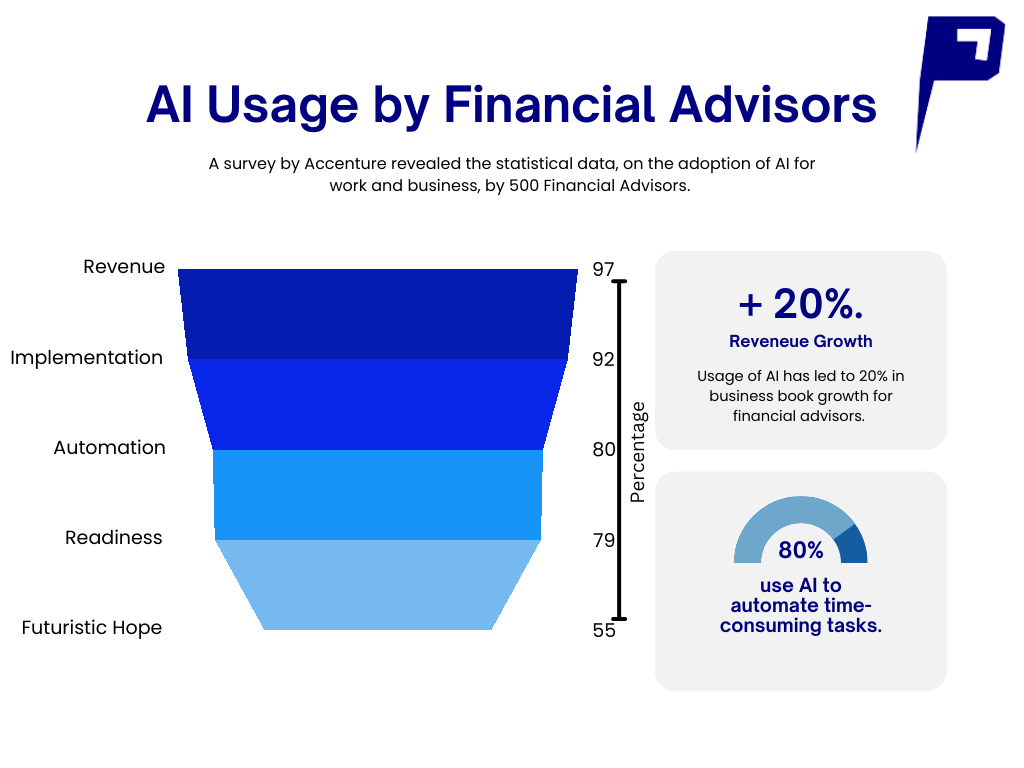

Let’s cover some statistics to show where we are heading.

Financial Advisory and Stock Market Trends

- The global financial advisory services market is projected to grow from USD 114.39 billion in 2023 to USD 204.24 billion by 2030, at a CAGR of 8.63%. [Ref]

- The Stock Trading and Investing Applications market was valued at USD 24.1 billion in 2022 and is anticipated to register a CAGR of over 19% between 2023 and 2032. The availability of real-time market data, news, and financial analysis tools is a significant growth factor in the market.

- There are a total of 5,316 registered stock brokers in India (SEBI statistics as of May 30, 2023).

Predictive Analytics for Trade Signals

AI models analyze historical price data, trading volumes, and technical indicators to generate real-time trade signals, improving decision-making for traders and investors.

AI-Powered Risk Management

Machine learning algorithms identify patterns in trading behavior to assess risk exposure and suggest optimal portfolio adjustments for risk mitigation.

Fraud Detection & Compliance Automation

AI detects anomalous trading activities that could indicate insider trading, market manipulation, or compliance breaches, ensuring adherence to SEBI and global financial regulations.

AI-Driven Personalization in Advisory Apps

Custom AI models analyze a client’s investment history, risk appetite, and financial goals to provide hyper-personalized stock recommendations and asset allocation strategies.

With the increasing integration of artificial intelligence (AI), machine learning (ML), and blockchain, the stock broking industry is likely to experience substantial efficiency gains. AI-powered trading algorithms are expected to gain popularity for executing high-frequency trades, while blockchain could improve transparency and security in financial transactions.

How Your Competitors Are Winning with Custom Fintech Solutions

Now that you know the numbers, let’s understand how your competitors are scaling. Those who want to create brand names always focus the most on customer experience. They build custom applications and software, understanding the needs and behaviors of their customers, and how they would like to be served. They create the experience, rather than depending on pre-built third-party software and applications for both internal and client-facing operations.

Here are some recently funded broking and stock market advisory startups and companies that have made customer experience their priority, leveraging their expertise, custom-built apps and software, AI, and partnerships to deliver a premium experience:

- Fintech firm BankSathi raises $4 million in Pre-Series A round

It uses priority algorithms to recommend financial products to advisors based on the customer’s profile and past transactions. - Groww is preparing for an IPO

As of February 2025, Groww, a leading Indian fintech platform, is preparing for an initial public offering (IPO) that could value the company at up to $8 billion. - Zerodha enters the asset management market

Zerodha Fund House, an asset management company in partnership with Smallcase, focuses on index funds with direct plans. - Mirae Asset Financial Group completes acquisition of Sharekhan

The long standing digital Broker Sharekhan, now acquired by Mirae, is also exploring new ways to leverage AI and Fintech for it’s customer acquisition goals.

These stories are built on the principle of “Customized Experiences.”

The trajectory of your business will stay upwards only if you keep upgrading with tech.

What Should You Do to Become One of Them?

We have curated sections for each one of you, based on your business domain and expertise.

Read on to find your roadmap to growth.

Algo Trading Platform for Brokers and Traders

A custom-built Algo Trading Platform empowers your business with lightning-fast execution, data-driven decision-making, and seamless strategy automation—all tailored to your unique trading requirements. Whether you’re a proprietary trading firm, hedge fund, or retail brokerage, having a scalable and compliant algo trading software that integrates with top exchanges, APIs, and analytics tools—ensuring precision, security, and performance—is a must.

We build custom trading software and apps, including algo trading modules with great speed and security.

Let’s build your edge in the market!

Custom Trading App for Brokerage and Investment Firms

You must bring a personalized experience to the table to gain and retain your clients.

A custom trading app isn’t just a tool—it’s a revenue-generating asset for your business. Whether you’re a brokerage, trading firm, or fintech startup, a tailored platform allows you to onboard more traders, enhance client engagement, and scale your operations efficiently.

Try providing more:

- Multi-asset trading with seamless API integrations.

- Advanced analytics & AI-powered insights.

- Automated trading strategies & portfolio tracking.

A fully custom solution lets you increase trading volumes, build brand loyalty, and maintain compliance—all while delivering an outstanding user experience.

Explore Custom Trading App Development Now

Stock Advisors Are Evolving: Scale with Digital Platforms

The stock advisory business is rapidly evolving, with technology playing a crucial role in scaling advisory services. Traditional one-on-one consultations are giving way to subscription-based digital platforms, allowing advisors to reach a wider audience while maintaining personalized insights.

A customer-facing B2C app has become a game-changer for RIAs and research analysts, enabling them to deliver stock recommendations, market insights, and educational content seamlessly. With live market data integrations, interactive dashboards, and automated alerts, these apps provide a structured way to offer advisory services while ensuring compliance.

Key Trends Shaping the Digital Advisory Space:

- Subscription-Based Advisory – A growing number of investors prefer structured, paid access to high-quality research over scattered, free content.

- Real-Time Engagement – Convert your Telegram and WhatsApp clients to app users, keep them engaged, and make advisory services more responsive.

- Finfluencer-Led Learning Platforms – Educational apps are gaining traction as investors seek deeper market knowledge beyond just stock tips.

- Data-Backed Decision Making – AI-powered analytics and live data feeds enhance credibility and improve investment strategies.

As regulatory landscapes evolve and investor expectations shift toward digital-first experiences, technology-driven stock advisory platforms are becoming essential for sustainable growth. The shift is not just about convenience—it’s about creating scalable, compliant, and engaging financial ecosystems that cater to the modern investor.

We build custom fintech applications and softwares for businesses who want to scale and leverage tech to it’s best use.

Got a unique idea for your business? Let’s discuss the tech side!