The insurance industry is experiencing its most significant transformation in decades. With the global insurtech market projected to explode from $19.06 billion in 2025 to $96.10 billion by 2032—representing a staggering 26% CAGR—the question isn’t whether your insurance business needs technology modernization, but how quickly you can implement it. Whether you’re an established insurance company, a forward-thinking broker, or a fintech entrepreneur entering the insurance space, understanding the critical role of custom insurtech development services has never been more crucial for your business survival and growth. The $152 Billion Opportunity: Why Insurtech Development is Non-Negotiable The numbers tell a compelling story. The insurtech market, valued at just $5.45 billion in 2022, is projected to reach $152.43 billion by 2030, growing at an unprecedented 52.7% CAGR. This isn’t just growth—it’s a complete industry revolution. For insurance professionals, this presents both an enormous opportunity and an urgent imperative. Companies that fail to modernize their technology infrastructure risk becoming obsolete in an increasingly digital-first market. Key Market Segments Driving Growth Automotive Insurance Leads the Pack: The automotive segment is driven by the rapid adoption of telematics and usage-based insurance models. If your business serves auto insurance, custom development services focusing on IoT integration and real-time data analytics aren’t just nice-to-haves—they’re essential for competitive survival. Health Insurance Shows Strong Momentum: Health insurance represents a major share of the market share in 2024, primarily driven by rising healthcare costs and the shift toward preventive care models. Custom insurtech solutions that integrate with health monitoring devices and provide personalized risk assessment are becoming table stakes. Brokers and Agents Still Dominate: Despite digital transformation, brokers and agents maintain a commanding 62.7% market share in 2024. This highlights a crucial insight: successful insurtech development must enhance rather than replace human expertise, creating tools that empower agents to serve clients more effectively. Critical Technology Challenges Facing Insurance Businesses Today 1. Legacy System Integration Crisis The insurance industry’s biggest challenge isn’t lack of innovation—it’s the burden of legacy systems that can’t keep pace with modern demands. Adapting these systems to meet digital-era requirements demands significant investment and robust change management strategies. The Custom Development Solution: Rather than wholesale system replacement, strategic custom development allows for gradual modernization through API-first architectures that bridge old and new systems seamlessly. 2. AI Implementation Without Losing Human Touch Applied AI is revolutionizing fraud detection, risk assessment, and damage appraisal. However, the challenge lies in implementing these technologies while maintaining the personal service that clients expect from their insurance providers. The Balanced Approach: Custom insurtech development services can create AI-powered tools that enhance agent capabilities rather than replace them, providing data-driven insights while preserving human judgment and relationship-building. 3. Data Security and Compliance Complexity With increasing regulatory requirements and cyber threats, insurance companies face unprecedented challenges in securing sensitive customer data while maintaining operational efficiency. The Security-First Development Model: Custom development allows for security-by-design approaches, ensuring compliance with industry regulations while building in advanced fraud prevention capabilities from the ground up. Why Generic Solutions Fall Short: The Case for Custom Insurtech Development Off-the-Shelf Limitations Generic insurtech solutions often promise quick fixes but deliver limited customization options. They force your business processes to conform to predetermined workflows, often resulting in inefficiencies and competitive disadvantages. The Custom Development Advantage 1. Tailored Business Logic: Custom solutions align perfectly with your specific underwriting criteria, claims processes, and customer journey requirements. 2. Scalable Architecture: Purpose-built systems can grow with your business, handling increased volume without performance degradation. 3. Integration Flexibility: Custom development ensures seamless integration with existing systems, third-party services, and emerging technologies. 4. Competitive Differentiation: Unique features and capabilities that generic solutions can’t provide become your competitive moats. Essential Insurtech Development Services for 2025 1. AI-Powered Claims Processing Systems Implement machine learning algorithms that can process claims 75% faster while maintaining accuracy rates above 95%. Custom development allows for training models on your specific claim types and business rules. 2. Blockchain-Based Fraud Prevention Leverage blockchain technology to create immutable audit trails and smart contracts that automatically detect and prevent fraudulent activities across the claims lifecycle. 3. Real-Time Risk Assessment Platforms Develop IoT-integrated systems that provide continuous risk monitoring, enabling dynamic pricing models and proactive risk mitigation strategies. 4. Customer Self-Service Portals Create intuitive, mobile-first platforms that allow customers to manage policies, file claims, and access support while reducing operational costs by up to 40%. 5. Advanced Analytics and Reporting Dashboards Build comprehensive business intelligence solutions that transform raw data into actionable insights for better decision-making across all business functions. ROI Metrics: What to Expect from Custom Insurtech Development Operational Efficiency Gains Revenue Impact Selecting the Right Insurtech Development Partner Technical Expertise Requirements Your development partner must demonstrate deep understanding of: Industry Experience Markers Look for partners with: Development Methodology Ensure your partner follows: Future-Proofing Your Insurance Technology Investment Emerging Technologies to Consider Quantum Computing: While still nascent, quantum computing promises to revolutionize risk modeling and cryptographic security within the next decade. Edge Computing: Real-time processing of IoT data at the edge will enable instantaneous risk assessment and dynamic pricing models. Advanced Biometrics: Next-generation identity verification and fraud prevention through behavioral biometrics and multi-factor authentication. Augmented Reality (AR): AR-powered claims assessment and damage evaluation will transform field operations and customer interactions. Building for Scalability Your custom insurtech solution should be architected to handle: Implementation Roadmap: Your Path to Insurtech Excellence Phase 1: Assessment and Strategy (Months 1-2) Phase 2: Core Platform Development (Months 3-8) Phase 3: User Experience and Integration (Months 9-12) Phase 4: Deployment and Optimization (Months 13-15) Taking Action: Your Next Steps The insurtech revolution isn’t coming—it’s here. Companies that delay technology modernization risk losing market share to more agile competitors who embrace custom development solutions. Immediate Actions for Insurance Leaders: Questions to Ask Potential Development Partners: Conclusion: The Future of Insurance is Custom-Built The insurance industry’s digital transformation isn’t just about adopting new technologies—it’s about fundamentally reimagining how insurance businesses operate, serve customers, and compete in the marketplace. Custom insurtech development services provide the strategic advantage

The Imperative for Custom Insurance Software in India and AI- The Impact of Custom AI & Automation on Insurance

In the rapidly evolving landscape of India’s insurance sector, the integration of Artificial Intelligence (AI) and automation for Insurance businesses is not merely a trend but a strategic imperative. As we navigate through 2025, the demand for bespoke software solutions tailored to the unique challenges and regulatory frameworks of the Indian market has never been more pronounced. At ProfitMatics, we are at the forefront of this transformation, delivering custom applications that enhance efficiency, ensure compliance, and elevate customer experiences in the fintech domain. Considering the competition among Insurance Brokers, building custom for the business is the best way to scale and digitalise. Sharing below the trends and use cases of custom Insurance software, for your journey with Fintech. The Imperative for Custom Insurance Software in India If you have been in the Insurance Industry since a decade or so, you probably are done with the limitations and issues that come packed with the third party SaaS solutions, such as agent management softwares, CRMs and Underwriting tools. Generic software often falls short in addressing the specific needs of Indian insurance agents and companies. Here are some you might feel relatable to. Common Limitations of Off-the-Shelf Insurance Software Minimal Branding or Personalization OptionsAgents are often stuck with templated interfaces and branding, missing opportunities to build a strong digital presence or offer tailored client experiences. Rigid WorkflowsPre-designed platforms often come with fixed processes that don’t adapt to the varied needs of Indian insurance agents dealing with diverse client portfolios and policy types. Limited Compliance FlexibilityKeeping up with IRDAI updates and state-specific regulations can be difficult when platforms lack customizable compliance modules. Generic Lead ManagementMany third-party systems provide a one-size-fits-all CRM that doesn’t account for the specific funnel stages or client behavior typical in the Indian insurance landscape. Poor Localization SupportMultilingual support, regional document formats, and locally relevant reporting features are often missing or poorly implemented. Difficult to Scale with GrowthAs insurance advisors grow from solo agents to teams or firms, many platforms fail to scale with new workflows, hierarchical roles, or custom access controls. Data Silos and Limited IntegrationsGeneric platforms may not integrate seamlessly with underwriting engines, KYC providers, WhatsApp automation, or accounting software used in India—leading to siloed data and inefficiencies. Custom solutions offer several advantages: First would be of course, having a software the way you want. Your workflow, your business operations, your strategies and your team management, all customised, just the way your vision stands. Apart from the “my own” feeling, it also helps with: Regulatory Compliance: India’s insurance regulations are intricate and frequently updated. Custom software can be designed to adapt swiftly to these changes, ensuring ongoing compliance. Localized Features: Custom applications can incorporate regional languages, local taxation rules, and specific underwriting guidelines, enhancing usability and relevance. Integration Capabilities: Tailored solutions can seamlessly integrate with existing systems, such as Customer Relationship Management (CRM) tools, policy management systems, and third-party APIs, streamlining operations. Automation and Data Handling for Richer Analytics: Purpose-built platforms can automate repetitive workflows like premium reminders, renewals, or document verification while capturing valuable data at every touchpoint. This data can then be transformed into actionable insights through embedded analytics and dashboards—supporting smarter decisions and personalized customer engagement. Scalability with Your Business Model: Custom software evolves with your advisory business—from a solo operation to a large agency—supporting new workflows, custom user roles, or additional branches without forcing major system overhauls. Enhanced Security and Data Ownership: With a custom solution, sensitive customer data is stored in secure, private infrastructure—not shared with third-party vendors—ensuring full control over data privacy, audit trails, and user access. Still considering if it’s the right choice? Take a look at what the rest of industry demands. According to a report by The Business Research Company, the global custom software development market is projected to grow from $44.52 billion in 2024 to $54.26 billion in 2025, at a CAGR of 21.9%, highlighting the increasing demand for bespoke solutions. The Business Research Company Got an Idea? Let’s brainstorm the solution together! Custom Insurance App Development: Meeting the Digital Demand With the proliferation of smartphones and increased internet penetration, majority of your audience has shifted to the small digital devices that carry the world. There’s a growing demand for mobile insurance applications that offer: User-Friendly Interfaces: Custom apps can be designed with intuitive interfaces that cater to the tech-savvy Indian demographic. Real-Time Policy Management: Policyholders can view, update, and manage their policies on-the-go. Instant Claim Processing: Integration of AI allows for real-time claim assessments and approvals, enhancing customer satisfaction. AI Voice Agents for customer support: Voice Agents are the new trend when it comes to customer support. Having data backed agents can drastically reduce the waiting time for your customer, solving the FAQs as well as personal queries in seconds, on a call that sounds humane and real. AI Recommendation System: With custom software, AI algorithms can be trained on your specific customer profiles, policy types, and historical data to deliver hyper-personalized product recommendations. This not only boosts policy conversions but also helps agents upsell or cross-sell based on real-time customer behavior, risk appetite, and financial goals—something generic platforms struggle to fine-tune. For understanding the trends in different Insurance Domains, read this article backed with stats and funded insurtechs. The Indian insurance software market size reached USD 146.40 million in 2024 and is expected to reach USD 275.83 million by 2033, exhibiting a CAGR of 6.75% from 2025 to 2033, driven by increasing digitalization and demand for personalized customer experiences. IMARC For more such trends of Insurance Industry, read this dedicated blog that explores the roadmap to Digitalisation for Insurance Brokers. The Impact of Custom AI & Automation on India’s Insurance Sector The integration of AI and automation in custom software solutions has led to measurable improvements: The global AI for insurance market is projected to grow from $7.71 billion in 2024 to $10.27 billion in 2025, at a CAGR of 33.3%, underscoring the transformative potential of AI in the insurance industry. The Business Research Company Future

From Traditional to Tech-Savvy: Redefining Loan Advisors in the Digital Lending Industry

With the change in the way loans are being processed and disbursed, it is equally important for the Loan Advisors to stay updated with the latest trends in the lending Industry. Traditionally, the loan advisors were receiving and managing data manually, with huge amounts of paperwork, managing the distributors and agents as well as direct customers, and keeping up with the changes in the bank’s process of lending. Now with digitalisation of banking and hence, lending process, the advisors no longer need to rely on papers and forms to extend advisory. What should you do, as a Loan Advisor with experience and expertise, in order to stand the competition against the tech-first loan businesses? Start with evaluating your current customer base: Who constitutes the majority of your clientele? Depending upon various factors like demographics, literacy, adequacy with usage of technology, and connectivity, you can understand what will be the best route to transform digitally. Deploy custom BRE and LOS systems: A BRE automates decision-making based on predefined rules set by lenders and regulatory bodies. In the context of a Loan Advisory Business, a BRE can help by: Automating eligibility checks Quickly assess if an applicant qualifies based on income, credit score, debt-to-income ratio, etc. Standardizing bank-specific requirements Different lenders have different rules; a BRE ensures compliance without manual intervention. Reducing human errors Ensures loan applications don’t get rejected due to incorrect documentation or missing details. Speeding up application approval Decisions on which bank/loan fits best can be made instantly. An LOS manages the entire loan application process from submission to disbursement. For a Loan Advisory Business, an LOS can: Integrate with Bank APIs Fetch real-time data and auto-fill customer details in loan applications. Loan management system with AI features Use AI and OCR to scan documents and verify authenticity. Provide a customer-facing dashboard Let customers track their loan status and manage their applications. Streamline loan submissions to multiple banks Allow applications to be processed across different lenders, directly from the app with the power of connected APIs. Connect with the leading loan lending mobile app development company in India.Discuss your idea now! Read this dedicated blog on the compliances in Fintech development. AI recommendation system Build an AI system that takes inputs like income, debt to income ratio, loan amount, current EMIs etc and gives out recommendations on the banks best to opt for. This way the onboarding process will be faster, and secure, making sure the customer reaches the team directly once he finishes this flow. Get your loan app development done by the expert Fintech Developers. Discuss your vision now. Gamification Don’t limit yourself to just loan advisory. You can retain customers using gamification of his current financial health, his loan process updates, a dashboard showing how he can opt for other loan options available from the business while maintaining the current loans, in how much time etc. These features would help with customer retention. Reports Who wouldn’t like a personalized dashboard that shows all the loans they have taken from your support, the EMI calendars for each, the financial health score, the credit score and the next available options? This would help them come back to you for any future needs, because now they know you take care of everything related to the loan! Get Started Today! Are you a Loan Advisor ready to transform your business with cutting-edge technology? We’re here to support you every step of the way. Whether you want to enhance your loan advisory services with a BRE and LOS system, integrate AI for better customer recommendations, or retain clients with gamification features, we have the expertise to help you succeed. Partner with us today to develop a custom fintech solution that will set your business apart from the competition and help you scale in the fast-evolving digital lending landscape. Contact us now to discuss your vision, and let’s build the future of loan advisory together!

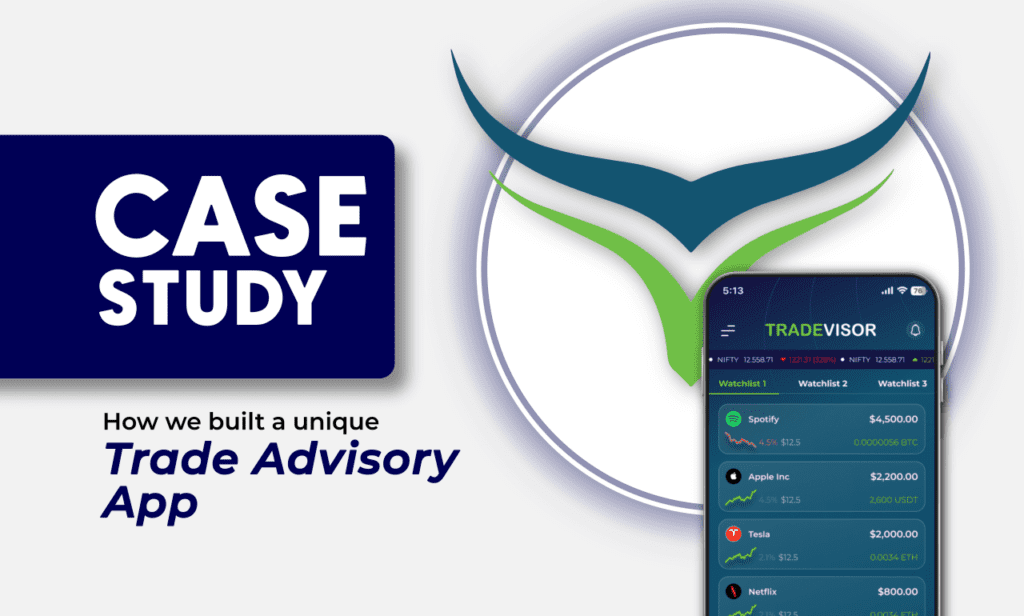

Case Study: How we built India’s unique Trade Advisory App- Tradevisor

Tradevisor is a cutting-edge trade advisory application designed to educate and empower aspiring traders. With its intuitive interface and feature-rich environment, Tradevisor aims to transform beginners into confident traders, fostering a community that thrives on knowledge and real-time insights. The app’s mission is noble: to raise awareness and provide essential trading education to a diverse audience, regardless of age or experience. You can check Tradevisor’s Project Highlights here. Problem Statement The journey to create Tradevisor was not without its challenges. The founder initially partnered with a development team that struggled to meet the project’s ambitious goals. Key issues included difficulties in integrating essential modules and delivering on critical features. The founder’s quest for a reliable partner led them to us, thanks to a strong word-of-mouth recommendation. With a leap of faith, they entrusted us with the half-completed project, tasking our team with transforming Tradevisor into a robust and user-friendly trading advisory app. Key Challenges 1. Real-Time Updates Integration In the fast-paced world of trading, timely information is crucial. One of the primary challenges we faced was integrating a real-time updates feature, essential for ensuring users could execute quick transactions without missing out on market movements. This required meticulous planning and advanced technical solutions to provide users with instantaneous access to market data. 2. Creating Interactive Forums Tradevisor targets those new to trading, aiming to create an inclusive learning environment. We recognised the importance of building interactive forums within the app where users could ask questions, share experiences, and learn from one another. Designing these forums with user intent in mind was vital to foster engagement and community support. Project Team and Roles: 1. Flutter Developer: Responsible for building the mobile application UI and implementing the business logic using Flutter and Dart. 2. Python Developer: Focused on developing the backend services, including database management and APIs. 3. Figma Designer: Designed the user interface and user experience for the mobile application. 4. QA Tester: Ensured the quality of the application by performing rigorous testing, identifying bugs, and verifying fixes. 5. Project Manager: Oversees the project, ensuring timelines are met and resources are allocated efficiently. 6. Team Leader: Provided leadership, assigned tasks, and ensured effective communication across the team. 7. Technical Head: Handled the technical architecture, ensuring best practices, and guiding the team on technical decisions around this project Project Timeline: ● Project Planning and Prototype: 4 days ● Design: 15 days ● Frontend Development: 35 days ● Backend Setup and Development: 40 days ● QA Testing: 20 days Tech Stack: Project Planning and Prototype: ● Figma: For wireframes and user flow design. ● QuickDBD: For database planning and schema design. Design: ● Figma: For UI/UX design. ● Gemini: For enhancing visuals and graphics. ● Canva: For creating marketing assets and additional design elements. ● Midjourney: For AI-generated visual content and illustrations. Frontend: ● Flutter: For building the cross-platform mobile app. ● Dart.dev packages: For implementing necessary functionalities in the app. Backend: ● Python: For server-side logic and backend services. ● FastAPI: For building efficient and high-performance APIs. ● WebSocket: For real-time data communication. ● Rest API: For standard RESTful communication with the frontend. ● Swagger: For documenting and testing APIs. Our Approach Our dedicated team set to work, employing agile development practices to rapidly address the project’s challenges. Here’s how we approached each key issue: Real-Time Updates: We implemented a robust backend architecture that utilized WebSocket technology, allowing for seamless real-time data streaming. This ensured that users received up-to-the-minute information on stock prices and market movements, facilitating informed decision-making. User-Centric Design for Interactive Forums: Understanding our target audience was key. We conducted user research to identify the needs and preferences of new traders. This insight drove the design of intuitive forums, complete with easy navigation, categorized topics, and a user-friendly interface that encouraged participation. Outcome The result was a highly intuitive and feature-rich Tradevisor app that exceeded expectations. Users can now access real-time market updates, participate in engaging forums, and explore a wealth of educational resources. The app not only meets the needs of its users but also aligns perfectly with its mission to empower aspiring traders. Conclusion Tradevisor’s success story highlights the power of collaboration and expertise in overcoming challenges. By stepping in to take over a half-finished project, we transformed Tradevisor into a leading educational platform in the trading space. We’re proud to have played a part in empowering the next generation of traders, helping them navigate the complexities of the market with confidence and knowledge.

How to build MVP for Pre Seed Funding

MVP or Minimum viable product can be any product with just enough features to be usable by early customers who can then provide feedback for future product development. While MVP can be across all industries and domains, in this blog we will focus on MVPs for Apps and how to build one for Pre Seed Funding. Don’t worry if you aren’t aware of these terms, this blog will make sure you take away a lot more than you came with! What exactly is MVP Application in the IT industry? A Minimum Viable Product (MVP) app is a basic version of a software application that includes only the core features and is used to test the viability of an idea. This is like the baby version of your dream app, with some of the important features, ready to be tested for the real world. Why should you invest in a Minimum Viable Product? It validates your product idea MVPs help validate if there’s a market for the app and if people want it. It helps gathering the most important proof- User Feedback MVPs help developers learn from early adopters and get insights on how to improve the app. Gives you a reality check MVPs help entrepreneurs avoid wasting time and money on features that no one wants. Lays foundation for full-scale development MVPs can be the foundation for developing a more polished and feature-rich app. Check out our Fintech Apps with great Ui Ux and features to understand more about Market Demand around Fintech. What is MVP in Agile Development? Agile development is a method of development where we focus on delivering a product in small, functional increments. This works really well when it comes to software development which helps to focus on collaboration, iteration and adaptability. Here MVP is an early version of a product that has the minimum features needed to test the product’s concept and gather user feedback. A reminder There have been long debates on whether MVPs are necessary and prerequisite for Pre Seed Funding. The answer is no. Does having a MVP help your pitch for pre-seed funding? Yes, when the MVP is done well and enhances the overall pitch. But it’s not essential, and a large (and growing) number of startups are able to use the pre-seed funding they attract to build the MVP. It totally depends on your startup’s needs and funding situation. How to build an MVP App and raise Funding in 2024 Here comes the important part of the blog. Suppose you have a great idea for your Fintech App, and have researched the market need of your imagined product, which is going to rise in numbers as you grow. But while seeking Pre Seed funding, you come to know that since your idea is already for an app, having an MVP can lead to building a better pitch and build trust to your investors. You can refer to our blog Flutter or React Native for Fintech App Development to understand and choose better for your Fintech App Development. Talking numbers first, on an average, building MVP for Fintech App Idea may range between $50,000- $100,000 depending on various factors like the core idea, features, legalities and other important factors. Here’s a quick breakdown of the cost of building an MVP for your Startup’s pre seed funding. Features: Payment processing, user accounts, data security. Estimated Budget: $50,000 – $100,000 Development: $30,000 – $70,000 Design: $10,000 Compliance/Legal: $5,000 – $15,000 Testing: $5,000 We can help you build an MVP for your Fintech startup at a competitive market price and limited time. Our team of experienced developers and Ux/Ui designers are always up for innovative and exciting projects. We would be happy to become a part of your Fintech Dream! Book a meeting now and let’s figure out your way to funding with a perfect to pitch MVP. Things to keep in mind while building an MVP 1. Market Research 2. Target Market Analysis and building User Persona 3. Key features- How is your app different from the sea of apps already present 4. Finally, build MVP by partnering with experienced and expert app developers who understand the nuances of Fintech. If you are starting your “Finding Investors” quest, we have got an exclusive list of Micro VCs and Pre Seed Investors, with their Emails, LinkedIn Profiles and Contact Info, just for you! Download the FREE SpreadSheet Now from the link below!

Flutter or React Native- Which is better for Fintech App Development

Bringing out the best requires choosing the best from the sea of options available. Choosing a development partner with proven expertise is crucial for ensuring your business outcomes align with your strategic goals. We are here to make it easy for you and your developers. Read this blog to understand the differences between Flutter and React Native and what would be best for you Fintech. What exactly is Flutter and React Native? You can skip this part if you are already a seasoned developer, but if you are someone beginning your Fintech Journey, this portion of the blog will make these big terms easy for you to understand. Flutter- The partner for your Fintech App Flutter is an open-source UI software development kit created by Google. It is often used for frontend development, though backend development is also possible. It can be used to develop cross platform applications from a single codebase for the Web, Fuchsia, Android, iOS, Linux, macOS, and Windows. You can check out our blog on Best Ui/Ux practices for Fintech Apps for more context: Flutter ships applications with its own rendering engine which directly outputs pixel data to the screen. This is in contrast to many other UI frameworks that rely on the target platform to provide a rendering engine, such as native Android apps which rely on the device-level Android SDK or React Native which dynamically uses the target platform’s built-in UI stack. Flutter’s control of its rendering pipeline simplifies multi-platform support as identical UI code can be used for all target platforms. Here’s a quick overview of how Flutter is great to use: Benefits of Flutter Also, Flutter 3.24 has been released and here’s a snippet of major changes: Significant GPU Rendering Improvements One of the major highlights of Flutter 3.24 is the enhancement in GPU (Graphics Processing Unit) rendering, which is critical for applications that require smooth animations and visually intensive graphics. Multi-View Embedding: A New Dimension of Flexibility The introduction of multi-view embedding in Flutter 3.24 is a game-changer for developers working on complex applications. It allows for the embedding of multiple Flutter instances within a single app, each managing different views or sections. Dart 3.5 Integration: Elevating Development Efficiency The release of Dart 3.5 has introduced a suite of new features and optimizations that improve both the development experience and the performance of Flutter apps. Dart 3.5 has brought enhanced type inference, making it easier to write concise, maintainable code. Advanced DevTools for Enhanced Development Experience A slice of happiness for the Developers- this latest version comes with advanced DevTools that offer you more powerful debugging and profiling tools. It’s an enhanced experience in itself. There is more to add, but let’s stick to our main learning for this blog. Now, Let’s move forward to React Native: Is this the same as React? NO. But its functionality is the same as React, right? WRONG. React Native was first released by Facebook as an open-source project in 2015. It is considered one of the top solutions used for mobile development. It is a free, open-source JavaScript framework for building apps. What makes React Native stand out is usability for both Android and iOS mobile apps. Also, since React Native was built based on React – a JavaScript library, which was already hugely popular when the mobile framework was released, it comes with an easy learning curve since developers are already accustomed to using React. Instagram, Pinterest and Skype are built on React Native. Here are some more benefits of using React Native: Which would be better for Fintech Applications? For Fintech app development, the decision of using Flutter or React Native often hinges on factors like performance, development speed, community support, and specific project requirements. Let’s discuss each of them here: Here’s an insight: Majority of Fintech Startups prefer using Flutter, for its obvious use cases and advantages. You can still choose between the two, but make sure your App’s features are not compromised by any of them. Performance: Flutter’s compiled native code often delivers superior performance compared to JavaScript-based frameworks like React Native. This is crucial for financial apps where speed and responsiveness are paramount. So for better performance delivery, Flutter is the better choice Cross-platform development: Flutter allows you to build apps for both iOS and Android from a single codebase, saving time and effort. UI/UX: Flutter’s rich widget library and declarative programming style make it easier to create visually appealing and consistent user interfaces. Hot reload: This feature of Flutter enables developers to see changes instantly, accelerating the development process. Community and ecosystem: While the Flutter community is growing rapidly, it may not be as mature as React Native’s, especially in terms of third-party libraries and tools specifically tailored for Fintech. Learning curve: If your team is primarily familiar with JavaScript, React Native might have a shallower learning curve. Flutter uses the programming language Dart , which isn’t that hard to adapt to. Large community: React Native boasts a vast and active community, offering a wealth of resources, libraries, and support. But with Flutter’s success strides and new versions being released, we think this might become a debatable topic in a few years. Third-party ecosystem: React Native benefits from a mature ecosystem of libraries and tools, including many specifically designed for Fintech applications. Bridging: React Native relies on a JavaScript bridge to communicate with native components, which can introduce potential performance overhead. So, we have summed up the differences between Flutter and React Native, the use cases for each, the pros and cons depending on different scenarios, and what factors you need to keep in mind while choosing for your Fintech App. Let’s go a step further and see which one is better for different domains of Fintech: Yes, we got it simplified for you! How can we be sure of this? We are experts in building Fintech Apps. Having built apps across all domains, we have the experience and expertise for choosing the right technology for each of them. You can

How Do Stock Market Brokers Make Money Through Apps?

In a simpler language with great examples! Remember those days when you had to be physically present, on a phone call with your Broker to converse Trades? So much has changed since then. But one question that strikes in the minds of new traders and anyone who wants to learn about Fintech, is how do brokers earn money, in the current scenario, with an app. Let’s understand the Business Model behind Brokers earning revenue through Trading Apps. Commissions on Trades The first one is of course commission.Whenever a user buys or sells a stock through the app, the broker takes a small percentage or flat fee as a commission. These commissions may vary based on the type of asset being traded (stocks, options, futures, etc.), and some brokers even offer different rates for frequent or high-volume traders. Here’s an example to understand this : A broker might charge $5 per trade or a percentage (e.g., 0.1%) of the total transaction value. What does this bring? Some brokerages charge commissions on stock and ETF trades, but these costs are currently on the decline. Look for : Otherwise, you could pay between $3 and $7 as a trading fee, depending on the online broker. Some brokers offer discounts for high-volume traders. Spread or Markup on Trades While commission is the most common way, some brokers make money through the bid-ask spread. This means they sell an asset to the user at a slightly higher price than they purchased it for (ask price) or buy it back at a slightly lower price than the market price (bid price). The difference between these prices, known as the spread, is kept by the broker as profit. Let’s assume that a broker buys a stock for $100 but sells it to the user for $100.05. The 5-cent difference here, is broker’s revenue. Revenue Model used here: Interest on Margin Accounts (Borrowed Capital Model) If a Trader wants to borrow money to trade (margin trading), he can do so by borrowing from his broker on some interest charges. This kind of trading allows traders to leverage their positions and potentially earn higher returns, but the broker earns interest on the funds. It’s a win- win situation for both of them. Discover a powerful Forex trading strategy that has helped achieve remarkable profits. This PDF contains strategies for every type of trade in easy and simple explanations. Click the link below to have access to the PDF Now! Subscription Fees for Premium Features Almost all stock trading apps available in the market offer premium services or features, such as advanced research tools, real-time data, or exclusive trading insights. Anyone too much into trading would be allured by these features. This marketing strategy brings extra revenue for Brokers.Example: – A broker might charge $15/month for access to the pro version of the app having in-depth stock analysis tools or faster trade execution. When does this model work and why? – This model works well for serious traders who need more sophisticated tools than what free accounts offer. – Recurring revenue from subscriptions provides consistent cash flow for the broker. We can help you build a Trading app of your vision with great features and high security. Book a 30 Min Meeting to discuss your idea. We promise it will be great for both of us! Order Flow Payments Another revenue stream for brokers is payment for order flow (PFOF). In this model, brokers route their clients’ orders to specific market makers or high-frequency trading firms, who then pay the broker for sending them trade orders. This doesn’t typically affect the client’s trade experience, but it helps the broker earn extra revenue. For example, a market maker might pay the broker a small fee (fractions of a cent) for each share traded through their platform. This works because, Account Management Fees Brokers with their own apps charge an account management fee, especially for clients who use their services for long-term portfolio management. This is typically a percentage of assets under management (AUM) or a flat annual fee. A broker might charge 1% of the total assets a user holds with them on an annual basis. The larger the AUM, the more fees the broker collects. In-App Advertising and Affiliate Partnerships Some brokers monetise their apps by incorporating advertising or affiliate partnerships. This might involve displaying relevant financial products or services to users, such as credit cards, insurance, or other investment platforms, and earning a commission for each referral. Here’s how it actually works: A broker might partner with a bank or financial institution and display ads for their savings accounts. Each time a user signs up, the broker earns a fee. Advertising partnerships can be particularly lucrative for brokers with a large user base. Affiliate marketing brings in additional revenue with minimal effort beyond app integration. Check out one of our Trading Apps with intuitive Ui/Ux and great features, built on the lines of trust, credibility and security. How Profitmatics Can Help You Build a Profitable Trading App If you are a broker, or aiming to become one, you can’t succeed without an app. A well-designed trading app is essential for staying competitive and maximising revenue streams. At Profitmatics, we specialise in building custom fintech apps tailored to the needs of brokers and traders. From seamless integration of revenue-generating features like commissions, and margin lending to premium tools for serious traders, our fintech solutions can help your brokerage grow its profitability. With our expert B2B fintech development services, we can : Design and build custom trading apps that attract more users.ANDEnsure your platform is secure, scalable, and user-friendly. Ready to take your brokerage to the next level? Contact Profitmatics today to discuss how we can help you build a successful trading app that generates significant revenue.

10 Reasons Your Fintech App Isn’t Gaining Sales: A UI/UX Expert’s Perspective

In today’s fast-evolving fintech landscape, a well-designed app is crucial for success. But even if your app offers revolutionary features, it might struggle to gain traction and convert users into paying customers. Why? The answer often lies in User Interface (UI) and User Experience (UX) design. Here’s why your fintech app might be missing the mark from a UI/UX expert’s viewpoint: Complex Onboarding Process First impressions matter. If your app requires users to fill out lengthy forms, verify numerous details, or jump through hoops just to get started, they’re likely to leave before they even experience its value. Solution: Simplify the onboarding process. Use progressive sign-ups, social logins, or guest access options to reduce friction and allow users to engage with the app more quickly. Poor Navigation A fintech app often has various functions like account management, investments, payments, and market tracking. If the navigation is unintuitive, users will get frustrated searching for basic features. Solution: Organise content logically. Use intuitive symbols, simple language, and a consistent layout. Make use of UX patterns like bottom navigation bars and search functionality to help users locate features effortlessly. Lack of Personalisation Modern fintech users expect apps to provide a personalised experience. An app that doesn’t adapt to user preferences—whether that’s by suggesting relevant financial tools or tailoring content to individual needs—will fail to engage users. Solution: Leverage data to offer customised dashboards, personalised notifications, and relevant content suggestions. Let users adjust settings and save preferences for a more tailored experience. Slow Load Times Financial transactions require real-time data. If your app is sluggish, users will quickly lose patience, especially when they are trying to make fast investment decisions. Solution: Optimize app performance by using faster algorithms, caching frequently used data, and minimising large file sizes. A delay of even a few seconds can cost you users and, consequently, sales. We know how crucial speed and security are for fintech apps, but we also recognize the importance of a seamless UI/UX. Feel free to explore some of our fintech apps, which combine great design with powerful features and top-notch performance. Check out our Fintech Apps Now! Cluttered Interface Fintech apps, by nature, handle complex data and transactions. But packing too much information onto the screen creates confusion. If users are overwhelmed by a cluttered interface with too many charts, numbers, or buttons, they’re likely to abandon your app quickly. Solution: Implement a clean, minimalist design. Prioritise essential features and keep secondary options tucked away in collapsible menus. Use white space to improve readability. Unclear CTAs (Calls to Action) If your app doesn’t clearly communicate its next steps, users won’t know how to interact with it. Whether it’s subscribing to a premium service or completing a financial transaction, if the CTA isn’t clear, users will feel lost. Solution: Use prominent, actionable CTAs that guide the user naturally. Buttons should stand out through size, colour, or placement. Ensure that they clearly indicate the intended action, such as “Invest Now” or “Upgrade Your Plan.” Insufficient Security Cues In fintech, trust is paramount. If your app doesn’t communicate security measures effectively, users will hesitate to proceed with transactions or even sign up. Ignoring Mobile-First Design Mobile is often the primary platform for fintech apps, yet some developers still treat mobile design as an afterthought. If your app feels clunky or poorly optimised for smaller screens, it’s going to cost you users. Solution: Ensure your app is responsive and mobile-first. Prioritise touch-friendly buttons, gestures, and simplified layouts to make navigating the app on a mobile device intuitive and seamless. Inconsistent Design Language Consistency in design is key to a seamless experience. If your app uses different fonts, colors, or layouts from screen to screen, it creates disorientation and looks unprofessional. Solution: Stick to a unified design language. Use consistent font sizes, colors, icons, and layouts throughout the app. This will enhance the flow and improve user confidence in navigating the app. Failure to Guide Users Some fintech apps expect users to understand all the functionalities without providing sufficient guidance. This lack of onboarding tutorials or in-app assistance can alienate users who are unfamiliar with certain features. Solution: Integrate micro-interactions, tooltips, and guided tours. Help users navigate the app with ease and offer explanations when necessary. Regular updates with “what’s new” or tutorial sections can also assist in driving engagement. Conclusion: Your fintech app’s UI/UX can make or break its success. From the first screen to the final conversion, every step should be smooth, intuitive, and enjoyable for the user. By addressing the pain points above, you can increase user retention, enhance satisfaction, and ultimately drive more sales. If your fintech app is struggling with user engagement or conversion, we at Profitmatics can help optimise your app’s UI/UX for better results. Let’s chat and turn your app into a user-friendly, revenue-generating machine! Book a Meeting Now !

11 Best Backtesting Apps/Tools for Indian Traders in 2024

If you are new to Trading, this blog is going to make things a lot easier for you. Keep reading to unlock some great Backtesting Tools!

Speed Up Your Fintech App: 5 Expert-Approved Techniques

If you are into Fintech App Development, we are pretty sure you must also face the challenges of balancing heavy loads of data and the demand for quick response time. The need for real-time processing for transactions, account updates, and notifications to meet user expectations for immediate action is crucial for Fintech Applications. Add the issue of integrating live data feeds for up-to-date market information and financial metrics. It fills the bucket, doesn’t it? Here are 5 strategies to ensure your Fintech app operates swiftly and efficiently, balancing multiple tasks seamlessly while delivering top-notch service. These insights are from Expert Fintech Developers with additional experience in building Stock Trading Apps, so rest assured you will find it very helpful! 1. Load Balancing Some of the best load balancers, depending on the needs of the Fintech application, are F5 BIG-IP and Nginx Plus, AWS Elastic Load Balancing, Google Cloud Load Balancing, and Azure Load Balancer. 2. Caching Strategies Use in-memory caching to cache frequently accessed financial data and reduce latency. The best options are: 3. Database Optimisation One way to optimize database performance is by creating indexes on the commonly queried fields and partitioning the large datasets to improve query efficiency. This would in turn manage the big data that Fintech Solutions require and help streamline the whole process of management. Another way would be to use Read Replicas. Using database read replicas to handle read-heavy operations can help reduce the load on the primary database. 4. Microservices Architecture To make scaling of different functionalities easier, break down the app into microservices, each handling specific functionality like transactions, user management, portfolios, and real-time stock data. 5. Real-Time Monitoring and Analytics Real-time monitoring and analytics are essential for the success of Fintech apps, whether they are payment solutions, trading platforms, or finance monitoring tools. At Profitmatics, our extensive experience in developing a diverse range of Fintech applications from the ground up has given us a deep understanding of the unique intricacies and requirements of each type. We ensure you receive cutting-edge technology that perfectly aligns with both your needs and technical specifications. Check Out Our Fintech Apps Now! Here are some of the Expert Chosen Tools to make your Application work seamlessly: Since you have read till now and are giving your time and effort, here is one bonus point for making that Fintech App of yours work seamlessly. Bonus: Content and Data Compression Also, use efficient data formats like JSON or Protobuf to minimize data payload sizes and speed up processing. These five (and one bonus) tips are articulated by our experts to make sure you arrive at the right tools in order to make your Fintech Solutions work better. If you want to lose all hassle and build a fully efficient Fintech App with all the latest features, catering to the demands of the Fintech Industry, we are here to share our expertise! Connect with us to build something revolutionary in the already-trending Fintech Industry.