How Do Stock Market Brokers Make Money Through Apps?

In a simpler language with great examples!

Remember those days when you had to be physically present, on a phone call with your Broker to converse Trades?

So much has changed since then.

But one question that strikes in the minds of new traders and anyone who wants to learn about Fintech, is how do brokers earn money, in the current scenario, with an app.

Let’s understand the Business Model behind Brokers earning revenue through Trading Apps.

Commissions on Trades

The first one is of course commission.Whenever a user buys or sells a stock through the app, the broker takes a small percentage or flat fee as a commission. These commissions may vary based on the type of asset being traded (stocks, options, futures, etc.), and some brokers even offer different rates for frequent or high-volume traders.

Here’s an example to understand this :

A broker might charge $5 per trade or a percentage (e.g., 0.1%) of the total transaction value.

What does this bring?

- High trading volume = more commission revenue.

- Some brokers offer tiered pricing based on user activity (e.g., lower fees for frequent traders, higher fees for casual users).

Some brokerages charge commissions on stock and ETF trades, but these costs are currently on the decline. Look for :

- Brokers that offer commission-free trading, including Fidelity, Charles Schwab, E*TRADE, Interactive Brokers and Robinhood.

- Commission-free ETFs. Even among brokers that charge trading fees, many have a list of ETFs that trade with no commission.

Otherwise, you could pay between $3 and $7 as a trading fee, depending on the online broker. Some brokers offer discounts for high-volume traders.

Spread or Markup on Trades

While commission is the most common way, some brokers make money through the bid-ask spread. This means they sell an asset to the user at a slightly higher price than they purchased it for (ask price) or buy it back at a slightly lower price than the market price (bid price). The difference between these prices, known as the spread, is kept by the broker as profit.

Let’s assume that a broker buys a stock for $100 but sells it to the user for $100.05. The 5-cent difference here, is broker’s revenue.

Revenue Model used here:

- Volume-based: Brokers who use this model rely on the volume of trades rather than individual commissions to generate revenue.

- It’s a quite common revenue path in forex apps, where spreads tend to fluctuate more.

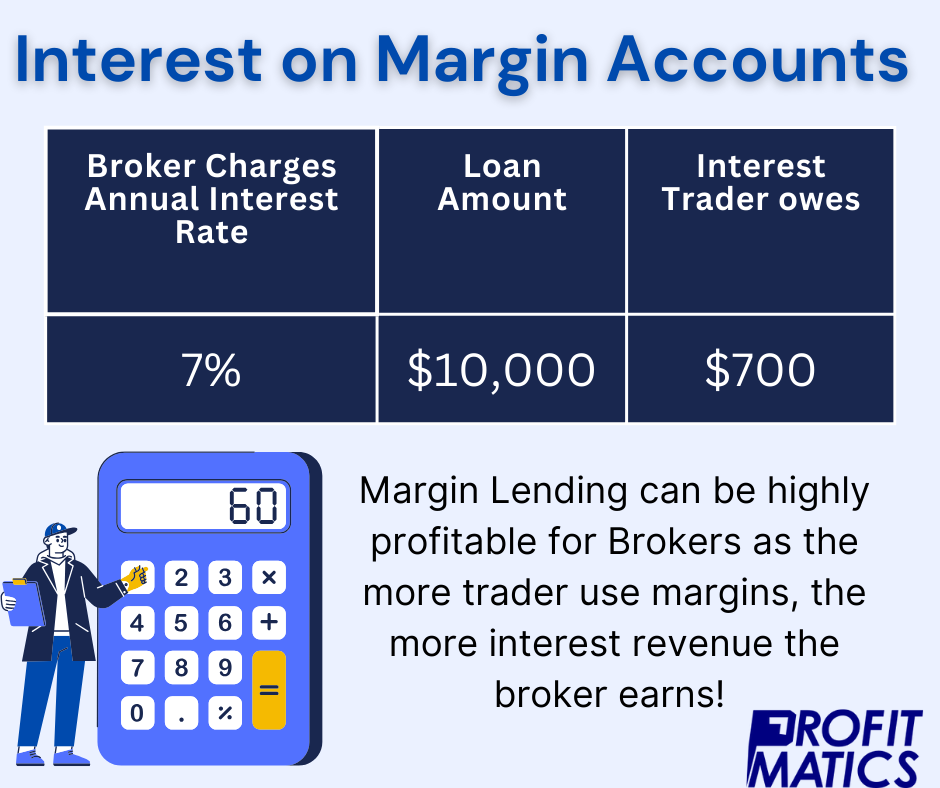

Interest on Margin Accounts (Borrowed Capital Model)

If a Trader wants to borrow money to trade (margin trading), he can do so by borrowing from his broker on some interest charges. This kind of trading allows traders to leverage their positions and potentially earn higher returns, but the broker earns interest on the funds.

It’s a win- win situation for both of them.

Discover a powerful Forex trading strategy that has helped achieve remarkable profits. This PDF contains strategies for every type of trade in easy and simple explanations.

Click the link below to have access to the PDF Now!

Subscription Fees for Premium Features

Almost all stock trading apps available in the market offer premium services or features, such as advanced research tools, real-time data, or exclusive trading insights.

Anyone too much into trading would be allured by these features.

This marketing strategy brings extra revenue for Brokers.

Example:

– A broker might charge $15/month for access to the pro version of the app having in-depth stock analysis tools or faster trade execution.

When does this model work and why?

– This model works well for serious traders who need more sophisticated tools than what free accounts offer.

– Recurring revenue from subscriptions provides consistent cash flow for the broker.

We can help you build a Trading app of your vision with great features and high security.

Book a 30 Min Meeting to discuss your idea. We promise it will be great for both of us!

Order Flow Payments

Another revenue stream for brokers is payment for order flow (PFOF). In this model, brokers route their clients’ orders to specific market makers or high-frequency trading firms, who then pay the broker for sending them trade orders.

This doesn’t typically affect the client’s trade experience, but it helps the broker earn extra revenue.

For example, a market maker might pay the broker a small fee (fractions of a cent) for each share traded through their platform.

This works because,

- High trade volumes allow brokers to earn significant revenue through these micro-payments.

- The more orders a broker routes to these partners, the more they can monetise order flow.

Account Management Fees

Brokers with their own apps charge an account management fee, especially for clients who use their services for long-term portfolio management. This is typically a percentage of assets under management (AUM) or a flat annual fee.

A broker might charge 1% of the total assets a user holds with them on an annual basis. The larger the AUM, the more fees the broker collects.

In-App Advertising and Affiliate Partnerships

Some brokers monetise their apps by incorporating advertising or affiliate partnerships. This might involve displaying relevant financial products or services to users, such as credit cards, insurance, or other investment platforms, and earning a commission for each referral.

Here’s how it actually works:

A broker might partner with a bank or financial institution and display ads for their savings accounts. Each time a user signs up, the broker earns a fee.

Advertising partnerships can be particularly lucrative for brokers with a large user base.

Affiliate marketing brings in additional revenue with minimal effort beyond app integration.

Check out one of our Trading Apps with intuitive Ui/Ux and great features, built on the lines of trust, credibility and security.

How Profitmatics Can Help You Build a Profitable Trading App

If you are a broker, or aiming to become one, you can’t succeed without an app. A well-designed trading app is essential for staying competitive and maximising revenue streams. At Profitmatics, we specialise in building custom fintech apps tailored to the needs of brokers and traders. From seamless integration of revenue-generating features like commissions, and margin lending to premium tools for serious traders, our fintech solutions can help your brokerage grow its profitability.

With our expert B2B fintech development services, we can :

Design and build custom trading apps that attract more users.

AND

Ensure your platform is secure, scalable, and user-friendly.

Ready to take your brokerage to the next level?

Contact Profitmatics today to discuss how we can help you build a successful trading app that generates significant revenue.