5 Innovations in Cybersecurity for Fintech Apps: Securing the Future of Finance

In the high-stakes world of fintech, where financial transactions and sensitive data flow through digital channels, the importance of robust cybersecurity measures cannot be overstated. With cyber threats evolving at a rapid pace, staying ahead in cybersecurity is not just about keeping up—it’s about leading the charge.

At Profitmatics, we deliver sophisticated fintech app solutions with exceptional security, leveraging our in-depth knowledge of industry standards.

Here how our Experts put up with the latest innovations in cybersecurity for fintech apps and how our expertise can help you protect your digital assets.

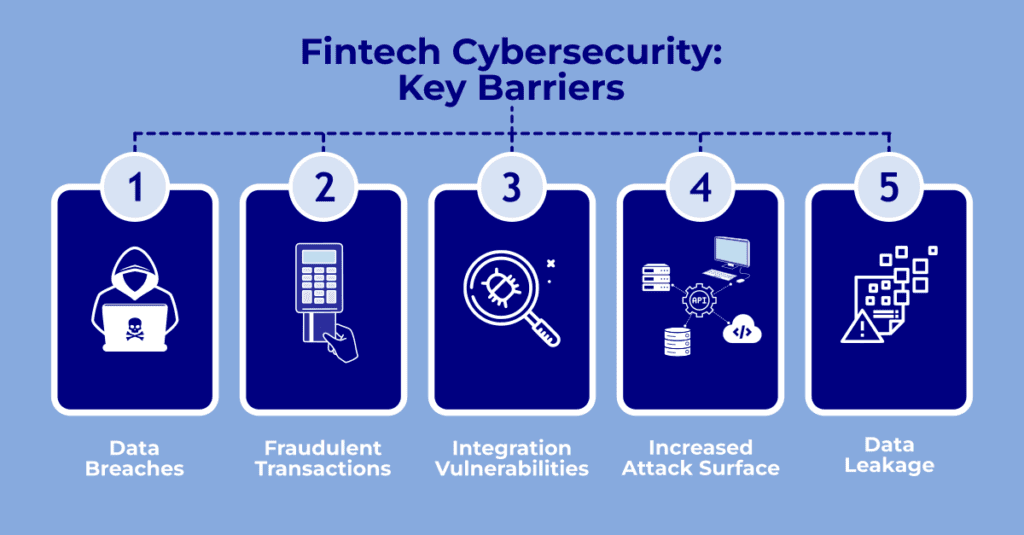

The Cybersecurity Landscape: Current Challenges

Fintech applications face numerous cybersecurity challenges, and the stakes are high. Here are some eye-opening statistics that underscore the gravity of the situation:

Data Breaches:

According to a report by IBM, the average cost of a data breach in 2024 was $4.45 million, with financial services being one of the most targeted sectors (IBM Security, 2023). Beyond financial losses, a data breach can severely damage a company’s reputation. Customers trust fintech companies with their sensitive financial data, and a breach can erode that trust, potentially leading to loss of business and decreased customer loyalty.

Fraudulent Transactions:

Implementing multi-factor authentication (MFA), using AI-driven fraud detection systems, and continuously monitoring transaction patterns can help in identifying and preventing fraudulent activities.

Integration Vulnerabilities:

Integration vulnerabilities occur when fintech apps incorporate third-party services or APIs, which may introduce security risks if not properly managed. These integrations can expose the application to additional attackers.

Increased Attack Surface:

Each third-party integration or API adds a potential point of failure. If these integrations are not secured properly, they can be exploited by attackers. A study by the Ponemon Institute revealed that 60% of organisations experienced a data breach due to third-party integrations in 2022 (Ponemon Institute, 2023).

Data Leakage:

Poorly managed integrations can lead to unauthorised access or leakage of sensitive data, especially if the third-party services are not compliant with security standards.

Top Players Securing the Future of Fintech

The fintech industry is renowned for its rigorous security measures. To fully appreciate its depth, it’s essential to highlight the top players recognised for their excellence in fintech cybersecurity.

CrowdStrike: Renowned for advanced endpoint protection and threat intelligence.

Bluefin Payment Systems: Specialises in secure payment processing and encryption.

Darktrace: Utilizes AI to detect and respond to cyber threats in real-time.

IBM Security: Offers comprehensive security solutions, including threat management and data protection.

Riskified: Focuses on fraud prevention and transaction security.

Gen Digital: Delivers robust cybersecurity measures to protect digital assets.

McAfee: Provides extensive threat detection and prevention solutions.

Onfido: Known for identity verification and fraud prevention technologies.

Trend Micro: Offers a wide range of security solutions for detecting and mitigating threats.

Source: Eden Data

Innovative Cybersecurity Strategies for Fintech Apps

1. Advanced Encryption Techniques

Data security relies on Encryptions. The advancements in encryption methods are setting new standards for fintech apps. Techniques such as AES-256 (Advanced Encryption Standard) and RSA (Rivest-Shamir-Adleman) encryption ensure that data remains secure both at rest and in transit. Both of these techniques have certain differences, which are explained below.

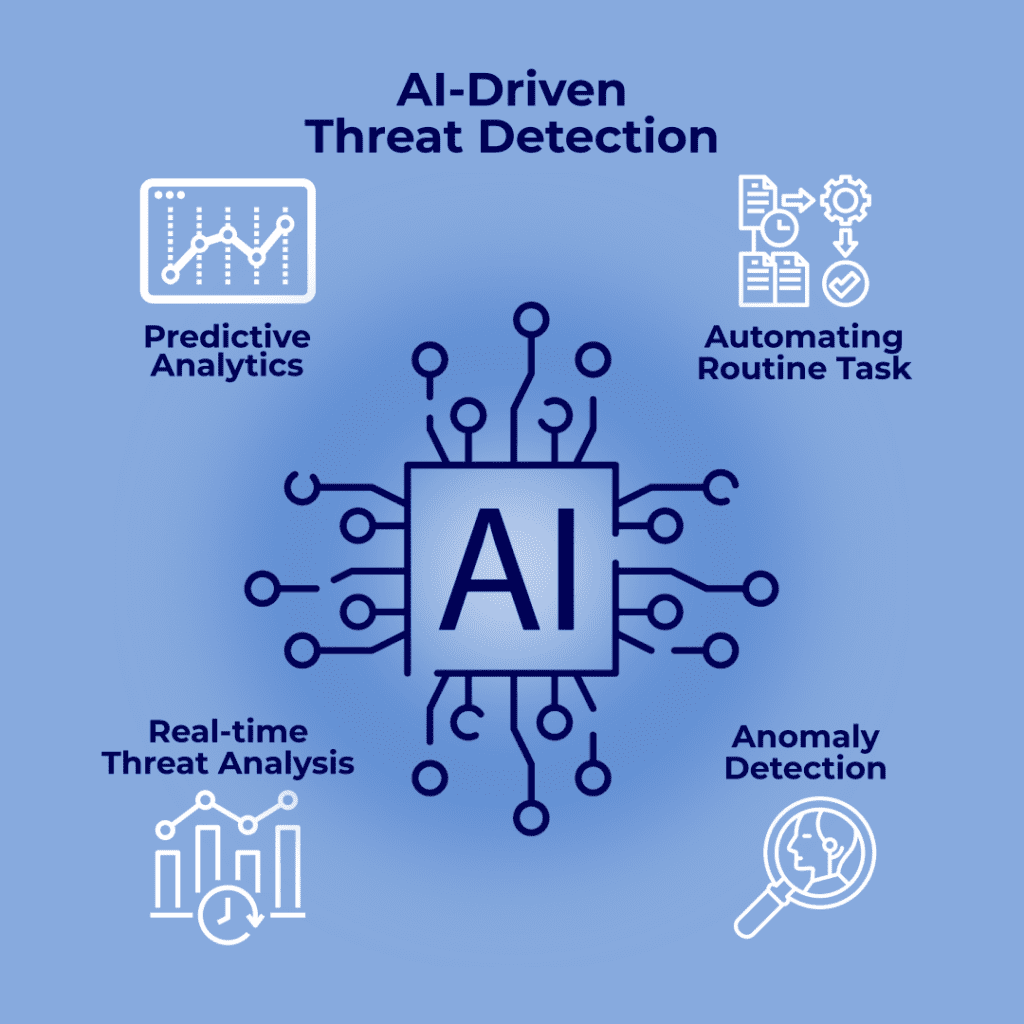

2. AI-Driven Threat Detection

Artificial Intelligence (AI) is revolutionizing cybersecurity with its ability to analyze large volumes of data and detect anomalies in real-time. Machine learning algorithms can identify unusual patterns and potential threats faster than traditional methods.

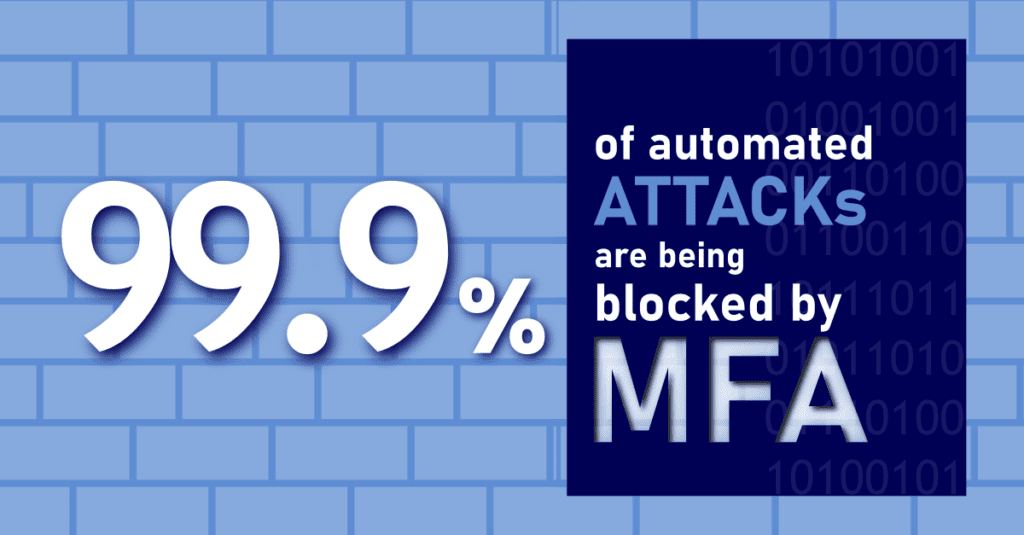

3. Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) adds an extra layer of security by requiring users to provide multiple forms of verification.

A study by Microsoft showed that MFA blocks 99.9% of automated attacks, making it a critical component in enhancing security (Microsoft, 2023).

4. Behavioural Analytics

Behavioural analytics involves monitoring user behaviour to identify suspicious activities. By analysing patterns such as transaction frequency and login locations, we can spot deviations that may indicate fraudulent activity.

5. Secure APIs and Third-Party Integrations

APIs are essential for modern fintech apps, but they can also be a security weak link if not properly managed. Using OAuth 2.0 and API gateways ensures secure data exchanges.

A report by the API Security Project found that securing APIs with OAuth 2.0 can greatly reduce the risk of API-related breaches.

Read one such case study on the making of a Trading App and how we managed API Integration on a challenging project with great success.

Why Choose Us for Your Fintech App ?

We understand how crucial Security is for Fintech App Development. At Profitmatics, we don’t just follow cybersecurity trends; we set them. Our team of experts is dedicated to implementing cutting-edge solutions that address your unique challenges.

Here’s why we’re the best choice for your fintech app development needs:

Expertise : Our developers have extensive experience in building and securing fintech applications.

Customised Solutions: With our expertise in Fintech, we understand the vision of our clients better, and tailor our cybersecurity strategies to meet the specific needs of the app while complying with industry regulations.

Proactive Approach: We stay ahead of emerging threats and continuously update our security practices to keep the app secure.

Success Stories: Our apps have been pivotal in accelerating business growth along with robust security. Through tackling challenging projects and integrating new features, we’ve helped clients achieve 2X to 3X increases in revenue. These enhancements have empowered our clients to significantly expand their market presence and drive their own paths to success.

Ready to Secure Your Fintech Future?

If you’re looking to fortify your fintech app with the latest cybersecurity innovations, look no further. Our team is here to ensure that your app remains secure, compliant, and ahead of the curve.

Connect with us today to learn more about our fintech cybersecurity solutions and how we can help you safeguard your digital assets.

Let’s work together to make your fintech app not just functional but fortified against any threat.